Your Quiz Results and Resources will arrive in your inbox in about 10 mins. In the meantime watch this short but important 7:22 min video I made for you to take your transformation to the next level... (yes it’s only that long so watch it all)

Your Quiz Results and Resources will arrive in your inbox in about 10 mins. In the meantime watch this short but important 7:22 min video I made for you to take your transformation to the next level... (yes it’s only that long so watch it all)

Congratulations! The 7C’s Of Resilience will arrive in your inbox in about 10 minutes. Before you go… WATCH THIS IMPORTANT (insert time) video I made for you to take breaking bad habits and fostering unstoppable progress!

OVER $16 BILLION AWARDED IN THE LAST YEAR!

Click the button below to book your appointment and get ready-to- submit estimates for your claim NOW!

OVER $16 BILLION AWARDED IN THE LAST YEAR!

Click the button below to book your

appointment and get ready-to-submit

estimates for your claim NOW!

3,000+

Clients

52,000+

Estimates

$16 BILLION+

Awarded

Why WriteLoss Is The #1 Provider Of Insurance Claim Estimates In North America!

What initially attracted the clients we continue to serve year after year was our track record. Fast forward to 2023 and we’ve helped our clients get over $16 Billion using our estimates!

Accurate Assessments

Our thorough approach to fine-lined policies paired with cutting edge on-site tech allows us to get every possible line item that should be paid for with your contractor or insurance claim. We've helped over 3,000 clients obtain estimates in a timely manner.

Faster

Turnarounds

You’re not just getting a paid-by-the-hour consultant; you’re getting a team of highly specialized inspectors and estimators who can assess, write & format your estimates and have them in your inbox in less than 48 hours! We guarantee this every time.

Cheaper

Estimates

Instead of keeping someone on retainer, or hiring a jack of all trades estimator on the spot, our diverse team allows us to focus on each aspect of your estimate, allowing us to save time, take on more clients, and ultimately… save our clients thousands in cost.

The Gold Standard...

Writeloss and its employees are very knowledgeable. They provide fast service and are always a pleasure to work with. WriteLoss is the Gold Standard when it comes to handling customer service. I would go as far as to say that any company should have this standard in their training programs. What an ecstatic surprise from the usually mundane customer service calls of today.

- Les Covan of Covan Estimating Inc.

An Extremely Valuable Resource...

WriteLoss is a team of incredibly talented professionals that have the ability to produce accurate estimates at a speed we could never achieve. The benefit of working with WriteLoss is their vast experience in nationwide property losses. WriteLoss is an extremely valuable resource to any company in the restoration industry. Recommending Writeloss is giving away one of my best kept secrets.

- Donald Brodsky of Flash Restore

WriteLoss Handles

The Jobs YOU Need!

On site:

Our team of inspectors will come to your location for detailed documentation, and will have your estimates worked on by our remote team in real-time, before our inspectors pack up and leave!

REMOTE:

You’ll fill out our simple in-take form, including pictures and any other pertinent information about your claim, and our team will immediately get to work writing, formatting and sending you your estimate!

Remote:

You’ll fill out our simple in-take form, including pictures and any other pertinent information about your claim, and our team will immediately get to work writing, formatting and sending you your estimate!

Large Loss:

No job is too big for us! Our incessant attention to detail and expansive and highly technical staff are the reasons we were able to create estimates such as Hollywood Beach Resort which was awarded with a grand total of $25,299,345.

Why Our Clients ONLY Use WriteLoss For Their Estimates!

We produce over $16 Billion in estimates annually, working to serve and support the insured, and our client’s bottom line.

Great Team of Estimators...

Writeloss is my go-to for Xactimate estimates because they have a great team of responsive estimators who understand the real world of insurance loss scopes.

- Lucas McCurdy of The Bridge Group

Level of Expertise...

For several years, I’ve used Writeloss services on complicated claims and catastrophic events. Their level of expertise in writing detailed estimates has helped with my company's bottom line profits. I would highly recommend them.

- Maria Slay of Rainbow International

THE WRITELOSS PROCESS:

1

Assessing Claims

Have our team come to you for documentation, or fill out our simple in-take form with policy information, floor plan & photographs for our remote team to review.

2

Writing claims

We’ll write out each and every item that is covered and send you an estimate that is formatted and ready to be sent to the insurance provider.

3

Fine-tune claims

You’ll look through our estimate, make adjustments and help provide any expertise your adjusters or lawyers need… and do it in a fraction of the time.

Companies We Worked With

The People We Serve:

Contractors:

Partnering with you to take over the time-consuming and meticulous process, so you can get jobs completed sooner and get better returns on your estimates!

LAWYERS:

We know that if there are ANY erroneous line items on your estimate it can destroy your case. That’s why attention to detail is paramount, so if you have to walk in the courtroom, your case is AIR-TIGHT!

Lawyers:

We know that if there are ANY erroneous line items on your estimate it can destroy your case. That’s why attention to detail is paramount, so if you have to walk in the courtroom, your case is AIR-TIGHT!

Independent & Public Adjusters:

Allowing you to scale your business by anywhere from 100-500%, leveraging our expertise and efficiency to settle more claims than you ever could on your own!

MEET THE TEAM

WHAT IS POSSIBLE WITH WRITELOSS

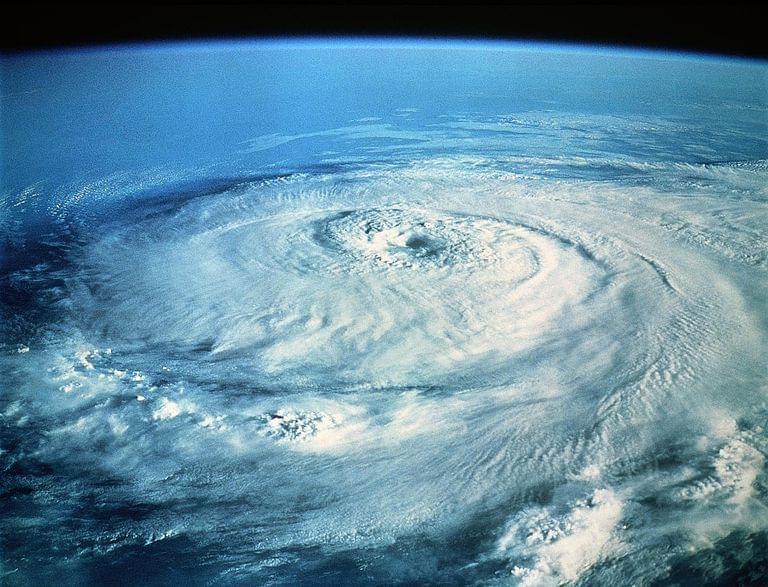

Hollywood BEach Resort

The site required a full rebuild due to Hurricane Irma’s 185 mile per hour winds. Due to the extensive damage, every square-foot of this property had to be documented and accounted for. The roof alone accounted for $3,535,928.73. With EVERYTHING on the roof and the exterior of the building, the total was: $25,299,345.07

Acosta residence

Before Writeloss received the claim, the client spent almost 3 years trying to resolve the issue on their own against their insurance company. WriteLoss' total for the damages came out to be almost 3 times more than the original estimate from the opposing carrier, which totaled $106,100.06, meanwhile WriteLoss’ total estimate of damages came to be $306,508.20.

ramirez residence

Home was affected by Hurricane Sally on September 10, 2017. Fortunately most of the damage was exterior, with some minor interior damage. This file had previously been quoted by a public adjuster in the amount of $52,690.03. The result of our quick turnaround came out to an extra $21,665.43 for the client, putting the total value of the damages at $74,355.46.

FAQ's

Q: Does your company write claims in ESX?

A: Yes!

Q: Do you write claims in Symbility?

A: Yes!

Q: Do you write content claims, or personal property coverage?

A: Yes! Sometimes, these claims take a little longer to document.

Q: Do you work with subcontracted writers?

A: No! On average our employees have been with us for 7 years. They are well trained, and work in stress-free environment.

Q: Do you write small claims?

A: Yes! We write estimates for claims between hundreds of dollars to hundreds of millions.

Q: Do you charge for edits?

A: We have a department set up specifically for edits, and do not charge for the first 2 edits of any file.

Q: Where are you located?

A: While we are headquartered in Florida, we typically are working in 23 states every day.

Q: If I have a problem or question is there someone I can talk to?

A: Yes! Our estimation staff work 21 hours everyday. We always answer the phone.

Q: What kind of estimates do you write?

A: We write any real property estimates, including maritime vessels.

ENROLL IN JUMPSTART YOUR HEART TODAY!

Check out the

14 day curriculum!

Check out the

14 day curriculum!

Day 1:

"Architecting in AWE”

Learn to sit in stillness, while allowing the mind to wander - focusing on the physical body.

DAY 2:

“Starting to Clear the Confusion”

No thought is the thought, is the next step and get the steps needed to start clearing the clutter of your mind.

Day 3:

“The Golden Loop & Learning to Shine”

Start to understand the creating from the “What” and letting go of the “How” releasing all the stress, pressure and anxiety from Success and Failure.

DAY 4:

“Seeking the Silence”

As the mind’s confusion begins to clear the next step deepens the awareness, starting with learning to clear the blocks within the bodies framework.

DAY 5:

"Cleaning house to See clearly”

Filling space to create your desires from true Infinite abundance and the awareness of what is created from the finite space.

DAY 6:

“Transmitter & Receiver”

Learning to harness focused attention & training of the mad-mind.

DAY 7:

“Feel the Flame”

Training the mind, Architecting Up.

DAY 8:

“Garden of Growth”

To imaginatively, trace an object to is origin, developing your laser, like focused imagination.

DAY 9:

“Holding the emotional space”

Creating (leading) from the bottom up - flipping the model from outside in to inside out.

DAY 10:

“Abundance is the Law”

Creating designs from nothing to completion, a true “how-to.”

DAY 11:

“It already IS”

What is the truth, that you refuse to accept about knowing “I AM?”

DAY 12:

“Are you the clay or potter?”

The power of our thoughts can become our “Prisons” or “Passions”

DAY 13:

"The Days of Days”

If you wish harmony in your world, you must create from and BE harmonious inside your heart, mind and body.

DAY 14:

"YOU ARE THE ARCHITECT!”

Looking back at how far we’ve come and LIVE Q&A

“Travis taught me how to coexist with fear, embrace challenges and seize opportunities that were out of reach before.”

"I've had an amazing experience with Travis, he has given me life tools to continually work on architecting myself."

we really want to make sure

you have everything you need

When you act now, you'll also receive customized worksheets and exercises created by my private team to get you started in knowing how to speak your audience’s language. ...

absolutely FREE! (WORTH $47)

Because this is a chance to sit back and reflect on the questions that very few people take the time to answer… and no one in their right mind should want to put that off for tomorrow!

Honestly… I Don’t. All I can tell you is that Jumpstart has helped 10’S OF THOUSANDS do away with the objections they once were limited by, and allowed them to live truly fulfilling lives by viewing everything through the lens of their own personal passions. With that said, if Jumpstart fails to deliver what it has for thousands of others, I will refund every penny, cause at the end of the day I don’t want to sell you something that YOU don’t need.

Because I believe it is my personal mission to help as many people remove the self-sabatoging habits that prevent them from living their lives ON THEIR TERMS! $197 is LITERALLY what it costs to advertise Jumpstart, and since it is comprised of pre-recorded videos, I see no need to raise that price in order to make a profit off of a smaller group of people.

YES! Whether it’s your business, your relationships or your lifelong purpose, the key denominator is YOU! I can personally testify that prioritizing the aspects of my life by my passions has allowed me to grow in every facet of life, building better businesses, deeper relationships, and allowing me to clarify what it is I really want out of this life!

Book Your Appointment

& SEE WHAT WRITELOSS CAN DO FOR YOU TODAY!

“Travis taught me how to coexist with fear, embrace challenges and seize opportunities that were out of reach before.”

"I've had an amazing experience with Travis, he has given me life tools to continually work on architecting myself."

don't take it from me

hear What My Students Are Saying!

- John Mendoza

- Kelly Shallman

- Shane Trujillo